Samsung surpasses Intel as the leading supplier of semiconductors worldwide.

According to a Jan. 26 report by industry research firm Gartner, Samsung Electronics is expected to surpass Intel and regain its status as the world’s leading semiconductor provider in 2024. Although this represents a resurgence for Samsung, Taiwan’s TSMC, the biggest foundry (contract semiconductor producer) in the world, is not included in the rankings.

Sales of Samsung Electronics seem to have significantly increased last year after the company struggled with diminishing profitability in DRAM and NAND flash goods.

It is anticipated that SK Hynix, the second-largest memory chip manufacturer in the world after Samsung Electronics, will move up to fourth place. The chipmaker profited from its dominant position in the market for high-bandwidth memory (HBM), which has been expanding quickly due to the increased need for AI. A key element of generative AI systems is HBM.

According to Gartner, worldwide semiconductor sales increased 18.1% from $530 billion in 2023 to $626 billion last year. The top 25 semiconductor suppliers in the world are expected to have seen a 21.1% growth in revenue last year, increasing their combined market share from 75.3% in 2023 to 77.2% in 2024.

A worldwide AI boom boosted sales of high-performance chips like HBM, but a slowdown in the semiconductor industry as a whole caused demand for general-purpose processors to decline. As a result, semiconductor businesses have had varying degrees of success.

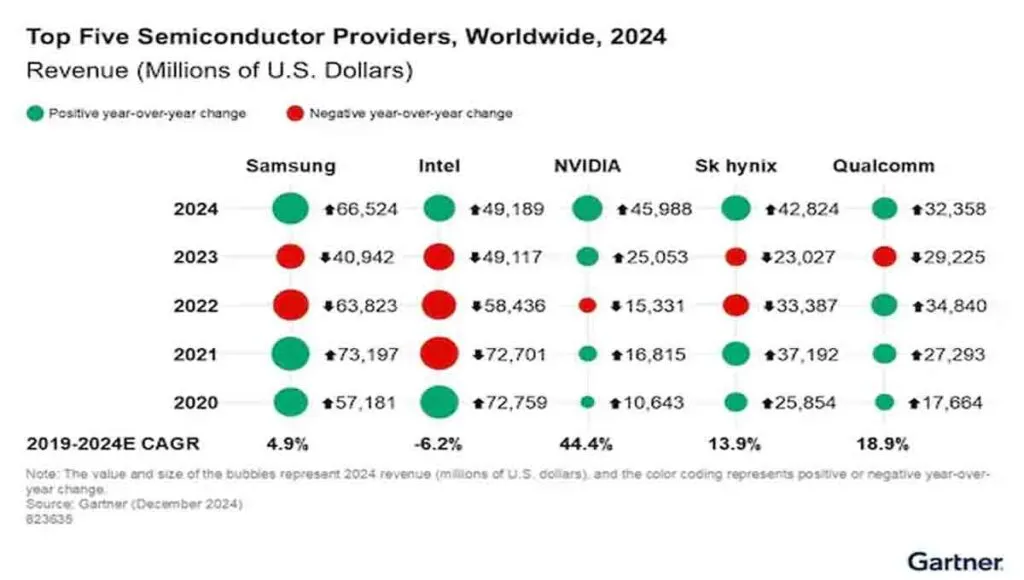

A year after losing the top rank in semiconductor sales to Intel in 2023, Samsung Electronics is predicted to reclaim it. An estimated $66.5 billion was Samsung’s semiconductor sales last year, a 62.5% increase over the year before.

According to Gartner, “Memory chip sales, which had been declining for two consecutive years, rebounded significantly last year.” “Over the five years leading up to 2024, Samsung is expected to have achieved a compound annual growth rate of 4.9%.”